The share of jobless households with very low work intensity has fallen since 2015.Continue reading

There are fewer poor elderly where people rely on more than just pension benefits, according to a Hungarian analysis of 25 countries. Corvinus researcher puts Hungary in the “liveable” category – based on information received from Corvinus University.

The EU’s 2017 action plan calls for a reduction by 15 million in the population at risk of poverty by 2030. In comparison,

the proportion of poor elderly people has increased significantly in European countries over the past decade, with 16.8% of over-65s living below the poverty line in 2021,

meaning that social security pensions alone do not provide a stable financial support.

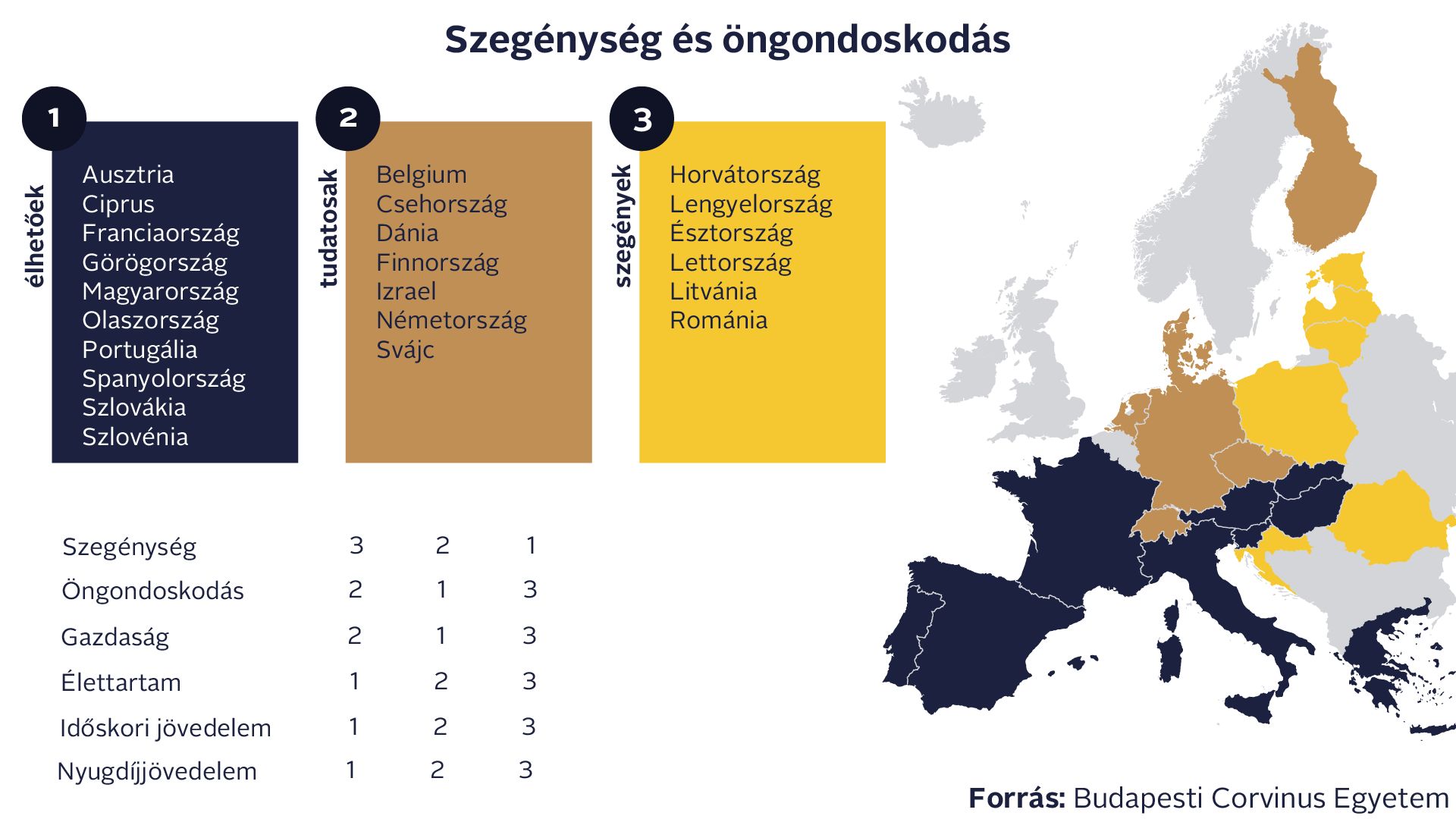

This is why it is important to understand the links between poverty and self-care in old age – as data shows from an analysis by Ágnes Vaskövi of 25 European countries, presented at two academic conferences in June by the researcher of Corvinus University of Budapest. For macro data, the researcher looked at national economic and poverty indicators, life expectancy and retirement age, as well as retirement and pension income. For micro data, she looked at variables that show the proportion of older people who have invested their savings in shares, mutual funds, individual retirement accounts, life insurance or business ownership.

Poverty and self-care. Color chart explanation: 1. Liveable 2. Savvy 3. Poor; Poverty, Self-care, Wealth, Longevity, Retirement income, Retirement income

The study divides the countries analyzed into three distinctive groups: the savvy, the liveable and the poor. In the savvy group – mainly in Northern and Western European countries such as Belgium, the Czech Republic, Finland and Germany – citizens plan ahead, are active and use a wide range of financial products to invest in the future, their country is in good economic shape but the pension system is not generous, therefore many work while they are still retired.

The middle category, including Hungary, is for ‘liveable’ countries, with average economic conditions, relatively low expected poverty in old age,

but the comparatively generous pension systems do not provide much incentive for people to take care of themselves. This includes Austria, France, the Mediterranean countries, Slovakia and Slovenia.

The third group, labelled ‘poor’, includes many poor elderly people in the Baltic States, Croatia, Poland and Romania, who are forced to work to support themselves because of scarce pension benefits, shorter than average life expectancy, being less financially aware in a country with poor economy.

From the source data, it is worth highlighting that Czechs open individual retirement accounts during their working years in the biggest proportion, (almost two-thirds of them) from the self-care instruments of the countries surveyed, while life insurance is the leading option for Germans (60.2%). Securities and companies are the most common purchases for Danes (59% and 6.5% respectively), and investment funds are the most popular among Finns (39.9%).

Photo: Pexels.com

The negative top performers in almost all categories are Bulgarians (between 0.4% and 4%), with Latvians least confident in investing in company ownership.

In Hungary, life insurance is the most popular form of savings among respondents (34.8%),

9.2% have opened an individual pension account in their lifetime, 5.2% have bought securities, while investment funds and company acquisitions were chosen by only around 3% of respondents.

The risk of poverty was measured using data from the AROPE European indicator, which shows when an individual’s income is less than 60% of the median income of the population as a whole. The over-65s are most at risk in the Baltic States, where a quarter of the age group is at risk, and around 37% of the over-75s, especially elderly women, are in a critical situation.

In Eastern and Western European countries, the average is 10% and 12-13% respectively, while in the more prosperous Nordic countries it is only a few percent.

In Hungary, the AROPE is favorable at 5.9% for the 65-75 age group and, almost uniquely, even lower at 4.3% for the over-75s.

The gender gap is not significant either, with women over 65 at a 0.7 percentage point higher risk of poverty than men.