From now on, Crete's capital is accessible from the eastern Hungarian city.Continue reading

Despite ongoing economic difficulties, the combined turnover of the 15 largest retail chains in Hungary has increased. The FMCG Retail Top List has been published, and Lidl’s leading position remains unchallenged, Világgazdaság reported.

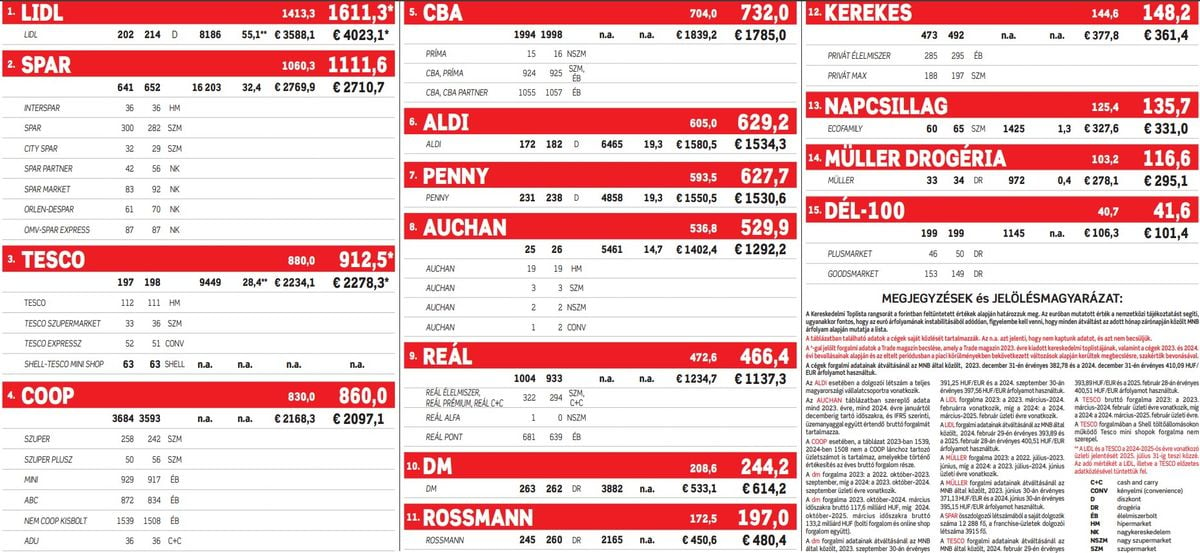

Since 2020, each year has presented serious economic hurdles, affecting the FMCG market. 2024 was no different. The total gross turnover of the top 15 retail chains approached HUF 8,400 billion (approximately EUR 20.82 billion) in 2024, compared to HUF 7,900 billion (approximately EUR 19.59 billion) in 2023. However, this 6% increase is considered modest given inflation and rising costs, according to Trade Magazin, which traditionally publishes the list on the first working day of June.

Ranking of Hungarian retail chains in 2024, visualizing their revenue performance, photo: Trade Magazin

Lidl’s first place is undisputed, with nearly 15% growth. The discount chain is now HUF 500 billion (approximately EUR 1.24 billion) ahead of Spar, which ranks second with growth of around 5%, only about a third of its 2023 expansion. Tesco remains in third place, with below-average growth, but the result still marks a significant improvement over 2023, when its turnover stagnated.

The rest of the rankings remain largely unchanged compared to 2023. Notably, among discounters, only Lidl achieved double-digit growth, while others saw average or below-average performance.

Drugstores such as Müller, Rossmann, and DM maintained strong double-digit growth of 12–14–17%, respectively. Though down from their previous years’ performance, their results still stand out. DM, Rossmann, and Lidl led the rankings with the best sales growth in 2024, followed by the eco-conscious Napcsillag chain with 8% growth.

Among leading Hungarian chains, Coop and CBA had similar results, while Reál posted a slight decline. All three, however, experienced a drop in the number of stores. Smaller Hungarian chains like Kerekes and Dél-100 performed below the market average.

Although there was a slight improvement in early 2024, renewed price increases led consumers to reduce spending again. Cost-cutting habits became widespread:

The 2024 FMCG Retail Top List brought no major surprises, but retail results continue to reflect broader economic challenges,”

said Zsuzsanna Hermann, editor-in-chief of Trade Magazin. “We shall hope that consumption and business success can still grow in 2025, though early signs and recent measures give limited cause for optimism.”

Via Világgazdaság, Trade Magazin; Featured photo: Pexels