There could be a slowdown in growth in 2023 due to the war in Ukraine and slower growth in household consumption.Continue reading

The consolidated gross debt of the general government at nominal value stood at HUF 47 884 billion (EUR 116 bn) at the end of September, or 75.9 percent of GDP, the lowest ratio in the last eight quarters, according to preliminary data available on the website of the Hungarian National Bank (MNB).

According to preliminary data, the net financing needs of the general government amounted to HUF 3,403 billion, or 5.4 percent of GDP, in the year ending in the third quarter, including HUF 815 billion in the third quarter of this year, or 4.8 percent of quarterly GDP. At the end of the third quarter, the non-consolidated stock of general government financial assets and liabilities amounted to 37.5 percent and 80.6 percent of GDP, respectively, making the net value of financial liabilities equivalent to 43.1 percent of GDP, 12.9 percentage points lower than at the end of last year.

General government net financial liabilities fell by HUF 759 billion in the third quarter and by HUF 3,675 billion in the first three quarters to stand at HUF 27,196 billion (EUR 65.8 bn) at the end of September.

The MNB report also shows that the stock of long-term securities among general government liabilities declined in the third quarter due to transactions, mainly explained by net sales of government bonds by households.

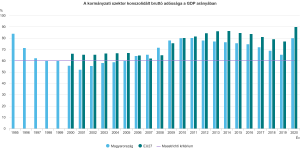

Graph by KSH

In this context it is worth taking a look at Hungary’s historic figures of national debt / GDP ratio. At the start of the first government of Viktor Orbán in 1998 the Debt stood at 60.5%, while by the end in 2002 it went down to as low as 55.6% (the Maastricht requirement is 60%). This was the figure that the new socialist government of Ferenc Gyurcsány had inherited, and

by the time the second left-wing government of Gordon Bajnai had ended in 2010, the national debt stood at an astronomical 80%.

One of the electoral promises of the Orbán Government was the reduction of this figure, and since their election win in 2010 the lowest point to which they could reduce it was 65.5% in 2019. The debt had started to climb up again as a result of the Covid 19 crisis, and the public indebtedness was further exacerbated by the invasion of Ukraine in February this year.

Featured Photo: MTI/Koszticsák Szilárd