Providers must ensure that immediate Euro credit transfers are credited to the payee's account within 10 seconds, 24/7.Continue reading

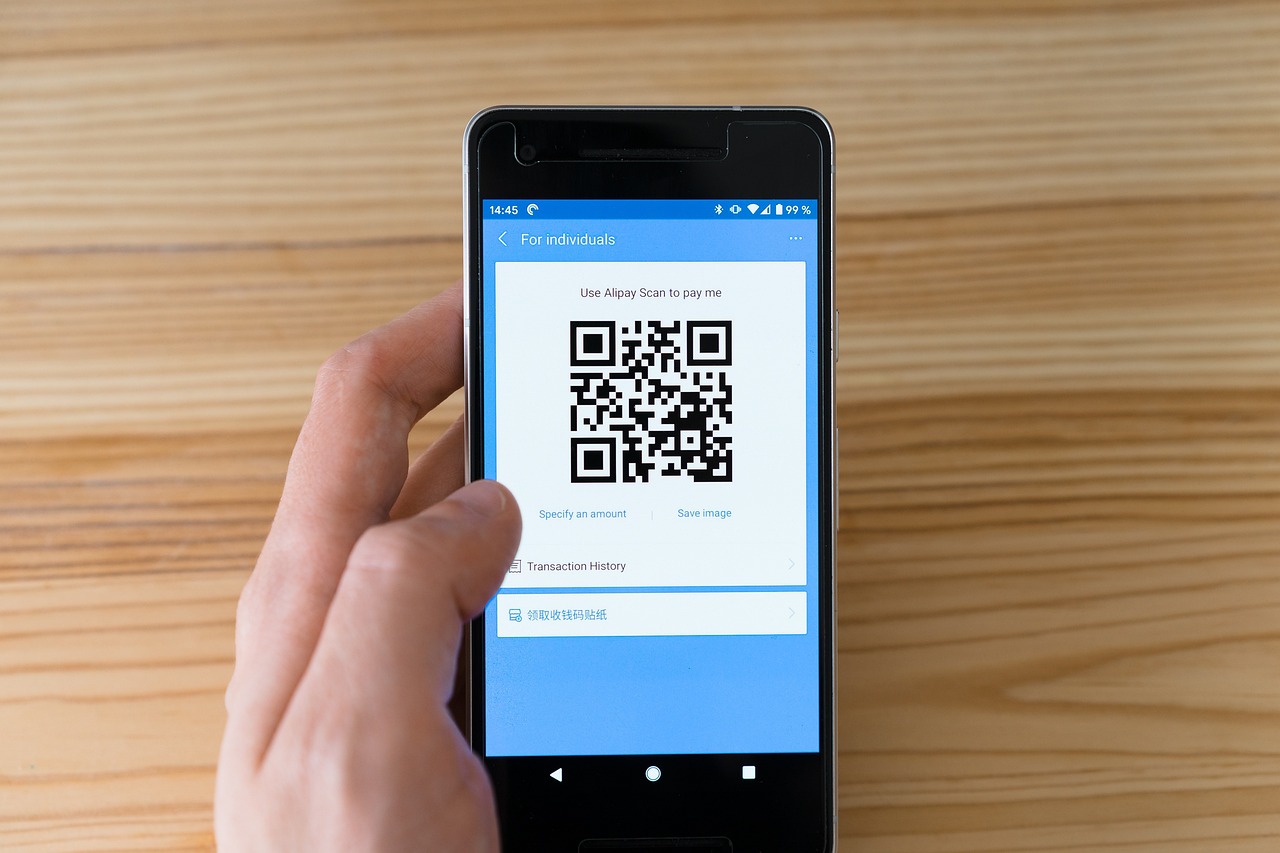

An important new feature is coming to life in Hungarian mobile banks: from September 1, all bank customers will be able to pay with a QR code. The new payment solution, branded qvik, will be free of charge for customers and can be used for online payments and at cash registers in shops. It will not bring new convenience compared to the card, but could be a cheaper digital payment solution for retailers, Portfolio writes.

From September 1, a new feature will be introduced to Hungarian bank customers: they will be able to initiate a payment by scanning a QR code, free of charge. In addition, two other technologies (NFC and deeplink) can be used to create payment solutions, but the QR code is expected to bring the biggest changes. At first sight, it is unlikely that shops will be flooded with QR codes, but

it is expected that there will be shops, retailers, SMEs and even supermarket chains that will introduce the solution in the coming days or weeks.

As usual for card payments, all shops will provide information on qvik payment, where you will see the logo below, you can pay by scanning the QR-code.

Photo via Pixabay

It is important to note that banks cannot charge customers any fees for “qvicking”. These payments are also exempt from financial transaction tax, therefore banks would not have to pass on this cost to customers anyway, unlike card payments, for which banks pay a flat rate of HUF 500 (EUR 1.27) per card per year. At the same time, a natural prerequisite for qviks is to have a bank account, which in most cases has a fixed account management or other fixed fees.

For card payments, most customers today pay a card-issuing or annual card fee to their bank (typically a few thousand forints), but beyond that, card payments are free at the transaction level. In this comparison, there is not much difference between card payments and qvik payments.

The Hungarian National Bank (MNB) has set itself the goal of creating a domestic electronic payment solution that can be an alternative or competitor to card payments, building on the Instant Payments System, also handling domestic instant transfers.

Qvik will be domestic, secure and price competitive,”

Barnabás Virág, vice-president of the MNB emphasized.

While for customers, it will be free, banks can already charge retailers for accepting qviks, but it will be cheaper than card acceptance, according to plans and statements. Domestic banks typically offer card acceptance with a fixed or minimum fee of between 1-2% of the value of the card and between HUF 50-100 (EUR 0.12-0.24), but cross-border providers may offer cheaper offers, sometimes without a fixed minimum fee.

So far, few banks have announced their plans for qvik payment services, but it is already known, for example, that OTP will offer qviks acceptance to merchants through SimplePay. The bank announced that they are preparing “a unified instant payment solution based on qvik QR code, qvik deeplink and qvik NFC”.

Although the MNB and market players expect the biggest changes to come from the QR code, qvik payments can also be used with other technologies:

Via Portfolio; Featured image via Pixabay