Minister Szijjártó cited low tax rates as a key factor in encouraging investment.Continue reading

How has foreign direct investment (FDI) changed globally over the past twenty years? – this is the question that the recently published report of the UN Trade and Development (UNCTAD) has sought to answer. The report primarily examines the complex situation of FDI in the light of the changes that have taken place over the last 20 years and the last few years, mainly in the economic and geopolitical context, writes the Oeconmus Economic Research Foundation in its summary.

As a consequence of the transforming globalization effects, a number of influences have affected the usual FDI trends and patterns over the last 20 years. There are currently three areas where there has been a striking change from the previous FDI framework.

Three main trends therefore emerge from the report:

As for the second point, the trend in Hungary is rather the opposite, reads the Oeconomus article. According to data from the Hungarian National Bank (MNB),

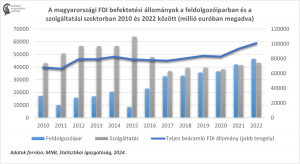

FDI inflows into manufacturing have been steadily increasing in recent years, while FDI inflows into the services sector have been shrinking. There is now a leveling off, with investment stock levels in both groups almost identical in 2022.

FDI stocks in manufacturing and services in Hungary between 2010 and 2022 (in EUR million). Source: Oeconomus

The UNCTAD report highlights a number of important issues that could be crucial in the coming years. These include the economic impact of geopolitical fault lines and the need for catching up in the least developed countries. Relocation and diversification of supply chains will be among the challenges for large companies in the coming period.

The latter could provide opportunities for developing countries to become alternative or complementary manufacturing hubs, which could attract additional investors to the region.

This will require the countries concerned to build up infrastructure and economic support, expand their trade agreements, and become members of economic organizations. In some cases, changes have already been made to adapt to changing trends, such as some West Asian and North African countries’ revised industrial policies. With a skilled workforce, low labor costs, a stable economic environment, and a business-friendly regulatory framework, they have been successful in attracting foreign investment, the Oeconomus article points out.

In diversifying supply chains, supporting and developing local suppliers and industries becomes a priority. In the future, industrial and investment policy decisions will need to consider how to maintain flexibility, both in terms of policy instruments and investment policy.

Via Oeconomus, Featured image: Facebook/BMW Group