The forecast shows rising employment, rising wages, and falling inflation in the coming years.Continue reading

MBH Bank (one of Hungary’s leading financial institutions) expects economic growth of 2.7 percent this year, which could reach 3.7 percent next year, Zoltán Árokszállási, head of the MBH Analysis Center, stressed at a press conference presenting the bank’s macroeconomic forecasts.

Their GDP growth forecast for this year of 3.5 percent, issued in January, was lowered due to weakness in export markets, and household consumption did not reach the expected level, reports Magyar Nemzet.

The long-term outlook is unchanged, just shifted by six months, hence the growth path of the domestic economy remains positive.

GDP growth of 0.8 percent in the first quarter compared to the previous quarter underpins the achievement of this year’s growth target of 2.7 percent, 0.2 percentage points higher than the government forecast.

According to Zoltán Árokszállási, real wage growth will play a major role in this. The trend improvement in consumer confidence indices since the end of 2022, also points in this direction. Labor market tensions have eased slightly recently, with the unemployment rate rising to levels not seen since the summer of 2020, while the economy could remain close to full employment in the period ahead.

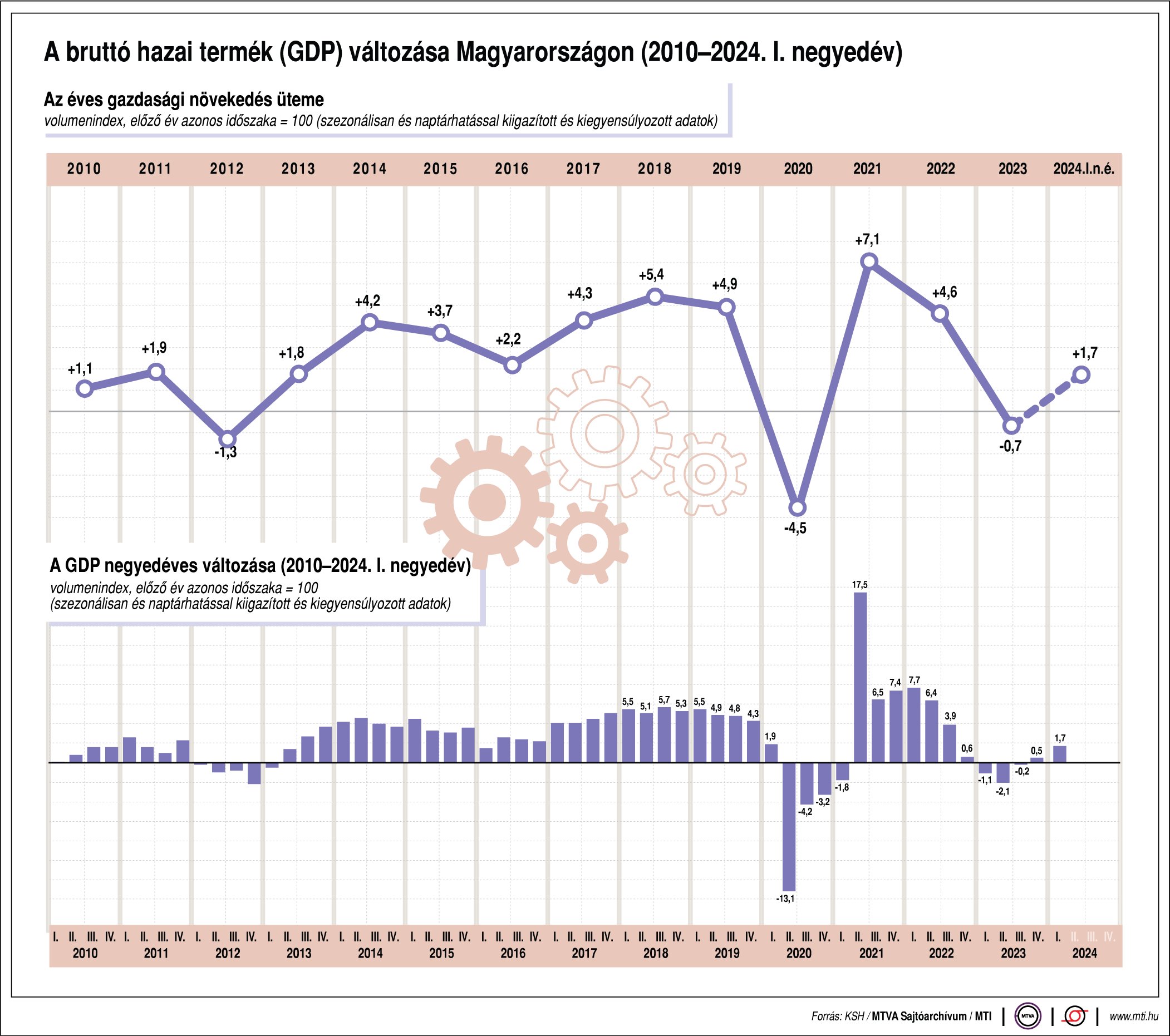

Change in gross domestic product (GDP) in Hungary, 2010-2024. Graph via MTI

The expert also stressed that disinflation continued at a slower pace in the first months of the year, but fell below the central bank’s tolerance band of four percent. Consumer price inflation could rise to five percent by the end of the year due to base effects and strong backwardation in the services sector in the coming months.

MBH Bank has left its January inflation forecast unchanged at 4.1 percent annual average, while their expectation for next year has been raised to 3.4 percent from 3.1 percent.

On the likely path of interest rates, Márta Balog-Béki, senior capital markets analyst at MBH Bank, said the current slower pace of interest rate cuts could continue for some time, but only minimal easing is expected in the second half of the year. She expects the 6.5-7 percent interest rate band communicated by the central bank earlier to be achievable by June at the current pace, but after that, only small steps are expected to bring the base rate down to 6.25 percent by the end of the year.

According to MBH analysts, the central bank‘s cautious interest rate policy is justified by the uncertain international environment and the change in expectations of major central banks to cut rates. At the beginning of the year, the market was expecting the Federal Reserve System (Fed), the central banking system of the U.S., to cut rates by 125-150 basis points this year, which proved to be an over-expectation. The European Central Bank is expected to start cutting rates before the Fed does.

Turning to the budget, Árokszállási emphasized that the MBH forecasts that the announced measures, with the postponement of some 675 billion forints (1.7 billion euro) of investment amounting to 0.8 percent of GDP, would help to maintain the deficit target of 4.5 percent. The bank’s analysts expect a weaker forint compared to the January forecast, due to risks surrounding EU funds and weaker-than-expected export growth. By the end of the year, the Hungarian currency could strengthen to 382.5 against the euro from 372.5 previously expected, while the average for the year could be 385.6 against the euro.

Via Magyar Nemzet; Featured image via Facebook/Coca-Cola HBC Careers