While the MNB is the first in the Central European region to ease, analysts list several factors that suggest the Central Bank of Hungary is letting up on the reins at the right time.Continue reading

As much as 35.7 tonnes of gold is held by the world’s central banks as a whole, according to the latest figures from the World Gold Council. This is equivalent to the weight of nearly 6000 male adult elephants. But where does Hungary stand on the league-table of gold reserves, asks the Oeconomus thinktank in its latest article.

The euro area had nearly 11,000 tonnes of gold reserves in March this year (30% of the world’s gold reserves). While central banks’ gold reserves declined between 2000 and 2009 , with central banks selling their gold reserves, a turnaround occurred in 2009 (as a result of the global economic and financial crisis). Central banks switched to buying gold in 2009 and since then the world’s central banks’ gold reserves have been growing steadily.

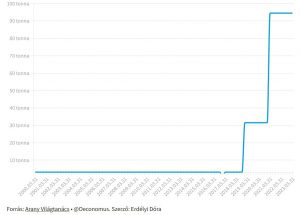

Hungary’s gold reserves were very low at 3 tonnes until 2018, when the Hungarian Central Bank (MNB) decided to increase its gold reserves tenfold, and then to 94.45 tonnes at the beginning of 2021.

Gold is primarily a safety net, providing a significant insurance in times of crisis or financial distress. As it is physically present in the central bank’s reserves, it can also be sold, stabilizing the financial system of a country in difficulty. The size of the reserve can also improve (international) investor confidence in the country. In addition, gold is considered one of the safest and most stable assets, free of credit risk.

Gold reserves held by the MNB. Graph: Oeconomus

The main risk associated with gold is its price, its volatility and the fact that its return can be around zero for many years, due to the cost of storing gold bullion. Gold price rose sharply after the 2008 crisis and we saw a price increase again in 2020. Compared to 2002, the world gold price is currently seven times higher. Moreover, in 2020, shortages due to supply-side problems also pushed up the gold price (gold mining was also hampered by restrictions due to the coronavirus epidemic).

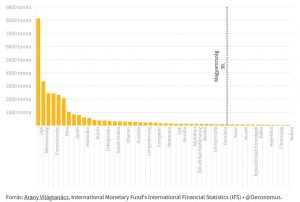

Global gold reserves ranking by total weight. Graph: Oeconomus

Hungary faced the international crises of the 2020s with significant gold reserves, and the rise in the international gold price after 2020 has also boosted the MNB’s gold reserves. After the fall of Communism, the MNB’s gold reserves declined in several steps from 46 tonnes in 1992 to 3.1 tonnes in 2010, and remained unchanged until 2018. The MNB first decided to significantly increase the gold reserve in 2018, based on long-term national and economic strategic considerations, with the level of the gold reserve increasing tenfold (from 3.1 tonnes to 31.5 tonnes) in October 2018, and then to 94.5 tonnes in 2021.

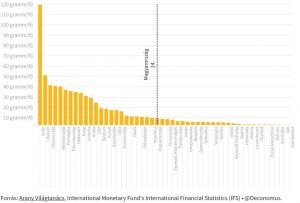

Global gold reserves ranking by weight per capita. Graph: Oeconomus

With 94.5 tonnes of gold reserves, Hungary ranks 38th in the international ranking of countries, according to the World Gold Council. The USA has the world’s largest gold reserves (8133.5 tonnes), followed by Germany (3354.9 tonnes), Italy (2451.8 tonnes) and France (2436.8 tonnes).

At regional level, Poland (228.7 tonnes) and Romania (103.6 tonnes) have larger gold reserves than Hungary, but both are also more populous. It is therefore also worth looking at gold reserves per capita. In this ranking, we are the region’s leader with 9.7 grams per capita, and Hungary is 24th in the world. Globally, Switzerland has the highest gold reserves per capita (119.5 grams per capita).

Via Oeconomus, Featured Photo: Pexels