Following Russia’s invasion of Ukraine, Hungary’s currency began its freefall- so much so that on Monday, there was a point when the forint euro exchange rate hit 400. While other countries in the region are also affected by the brutal weakening, only the currency of sanctioned Russia – which is on the brink of an economic collapse – has fallen more than the Hungarian forint, and even the Ukrainian hryvnia has managed to fare better. Analysts believe the main reason for the extreme decline in the forint’s value is Hungary’s close proximity to the conflict zone, and the country’s high dependence on Russian energy.

After last week’s almost continuous, sharp downward turn, the Hungarian forint’s exchange rate hit a new historic low on Monday, briefly reaching 400 against the euro.

While it is true that since Russia’s war on Ukraine most currencies in the Central Eastern European region have suffered a huge capital outflow, including the Czech koruna and Polish zloty, none of these countries have seen the value of their national currency fall as much as Hungary.

The exchange rate of the forint against the euro dropped by more than 8 percent between February 21st and March 6th. In addition, the currencies of Poland and the Czech Republic have been the hardest hit among the neighboring countries, with the zloty losing 7.6 percent, and the Czech koruna 5.3 percent against the euro.

What may be even more shocking to many is that Hungary’s currency is depreciating even faster than that of Ukraine, a country currently at war. Only Russia’s rubel, which is facing an economic meltdown as a result of unprecedented sanctions against Moscow, fares worse than the forint.

What is behind the forint’s free fall?

The sharp and rapid weakening of Hungary’s currency is due to several factors, the most important of which is of course, Russia’s invasion of Ukraine.

In an article on the issue, Telex writes that the unpredictable economic environment caused by the war usually pushes investors to allocate their money into safer assets. As a result, they tend to dispose of currencies and assets from smaller, more vulnerable countries and buy safer ones (e.g. US dollar, Swiss franc). This increases the demand for these currencies and hence their prices, while the reduced demand dampens the price of currencies of weaker economies such as Hungary’s.

Although it is not just the forint that is suffering in the current situation, as the potential economic impact of the crisis has also weakened the euro against other major currencies such as the dollar, the franc, and the yen, and the Hungarian forint and other regional currencies have fallen even more sharply against them.

Another important factor for Hungary is the fact that the war is taking place directly in a neighboring country, and its economic and especially energy exposure to Russia and Ukraine is considerable.

Even though only 3.6 percent of Hungary’s export goes to Ukraine and Russia, Hungary is among the most Russiann-dependent countries of the EU when it comes to gas import and nuclear energy, which renders market players extra careful.”

The possibility that sanctions could be extended to the energy sector has also caused concern among many.

Additionally, some believe that the government’s “political double game” between Moscow and Brussels could have also had a role in the sharp decline in the forint’s value.

As Telex notes, the increasing economic risks presented by the war between Russia and Ukraine could also weaken the willingness of foreign companies and investors to do business and invest in Central Europe. In addition, the armed conflict and the imposed sanctions are expected to dampen growth not only in Hungary or Central Europe, but also in Europe as a whole. These effects could reduce capital inflows, putting further negative pressure on the exchange rate.

Lastly, some analysts suggest that due to Hungary’s extremely weak currency, short-sellers have also entered the forint market. In other words, many are betting on a further weakening of the forint. This can also affect the exchange rate of the forint, although it is unclear exactly how much of an impact they will have.

The government blames Western sanctions for the plummeting forint

After hitting a historic low of 400 in the forint/euro exchange rate on Monday, several members of the Hungarian government shared their take on the situation, blaming the fall in the forint’s value not on the war, but rather on Western sanctions.

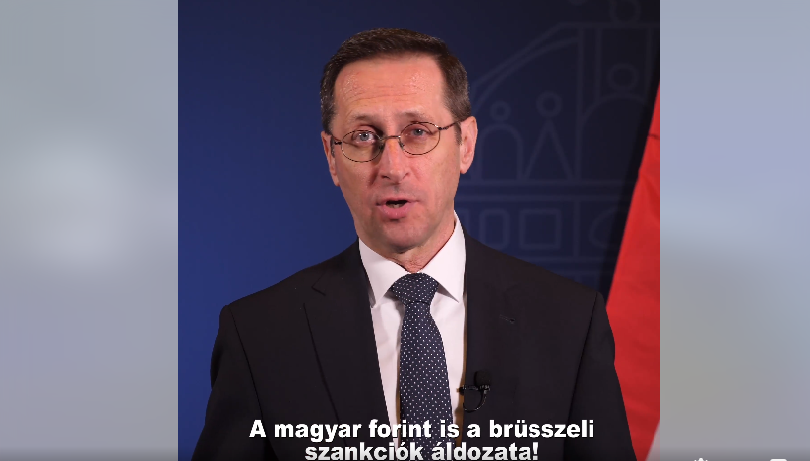

“The European and US sanctions imposed in the wake of the war in Ukraine are causing extreme uncertainty in the European economy. These sanctions are also causing serious difficulties for the Hungarian economy, and the forint is one of the victims of the Brussels sanctions,” Hungary’s Minister of Foreign Affairs and Trade, Péter Szijjártó said.

Finance Minister Varga Mihály made a similar comment, saying that the Hungarian forint is weakening because of the Brussels sanctions, which are already causing serious losses to the Hungarian economy. He said the biggest threat to Hungary and the Hungarian forint is that there are those who would extend the sanctions to the energy sector.

Those who want to extend sanctions want to make the Hungarian people pay the price of war,”

Varga said.

The Prime Minister’s economic adviser also repeated the same reasoning to pro-government daily Magyar Nemzet, blaming the extreme weakening of the forint on EU sanctions (which were also supported by the Orbán government – editor). However, Márton Nagy also suspected conjecture against Hungary’s national currency.

Foreign bond holdings have not decreased, which shows that speculation is going on against the forint, as investor confidence has not diminished.”

The government and the central bank (MNB) are constantly monitoring developments. Last week’s interest rate hike was already part of this process, and it is likely that the government and the MNB will consider an action plan to protect themselves from further negative effects if necessary, Nagy added.

Featured photo via Ungarn Heute